Dear Partners,

The present financial system’s debt growth remains significantly and continuously higher than its economic growth. In turn, we anticipate the continuation of investors’ shifting into previously perceived risk assets in 2024. A select group of today’s risk assets will ultimately be the foundation of an improved global economy, one where economic growth exceeds debt growth. Economic growth higher than debt growth remains the only path to a sustainable global economy

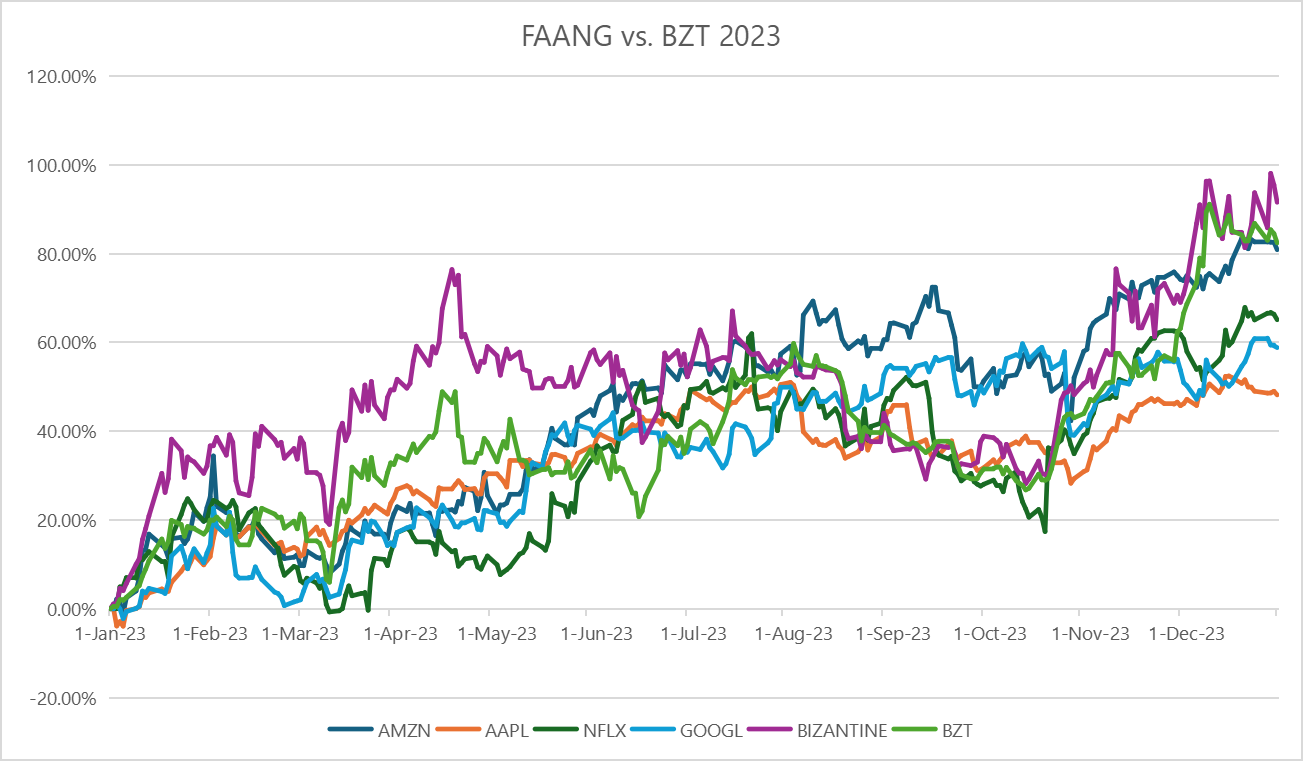

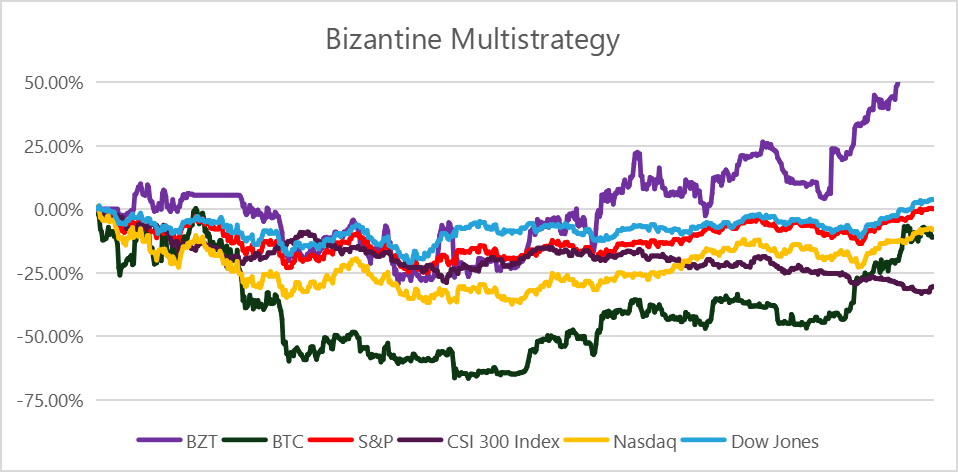

10/1/2023 - 12/31/2023 (4th Quarter):

| Bizantine | 32.8% |

|---|---|

| BTC | 56.7% |

| Nasdaq | 13.6% |

| Dow Jones | 12.7% |

| S&P 500 | 11.2% |

| CSI 300 Index | -6.9% |

1/1/2023 - 12/31/2023 (2023):

| Bizantine | 74.6% |

|---|---|

| BTC | 155.42% |

| Nasdaq | 43.4% |

| S&P 500 | 24.2% |

| Dow Jones | 13.7% |

| CSI 300 Index | -11.7% |

1/1/2022 - 12/31/2023 (Inception):

| Total Return | |

|---|---|

| Bizantine Multistrategy (BZT) | 33.6% |

| Apple | 8.4% |

| Dow Jones | 3.7% |

| S&P 500 | 0.1% |

| Nasdaq | -8.0% |

| Amazon | -8.9% |

| Bitcoin | -11.4% |

| CSI 300 Index | -30.5% |

| Tesla | -37.9% |

| Ark Innovation ETF | -46.0% |

致所有 Bizantine 的投资人们:

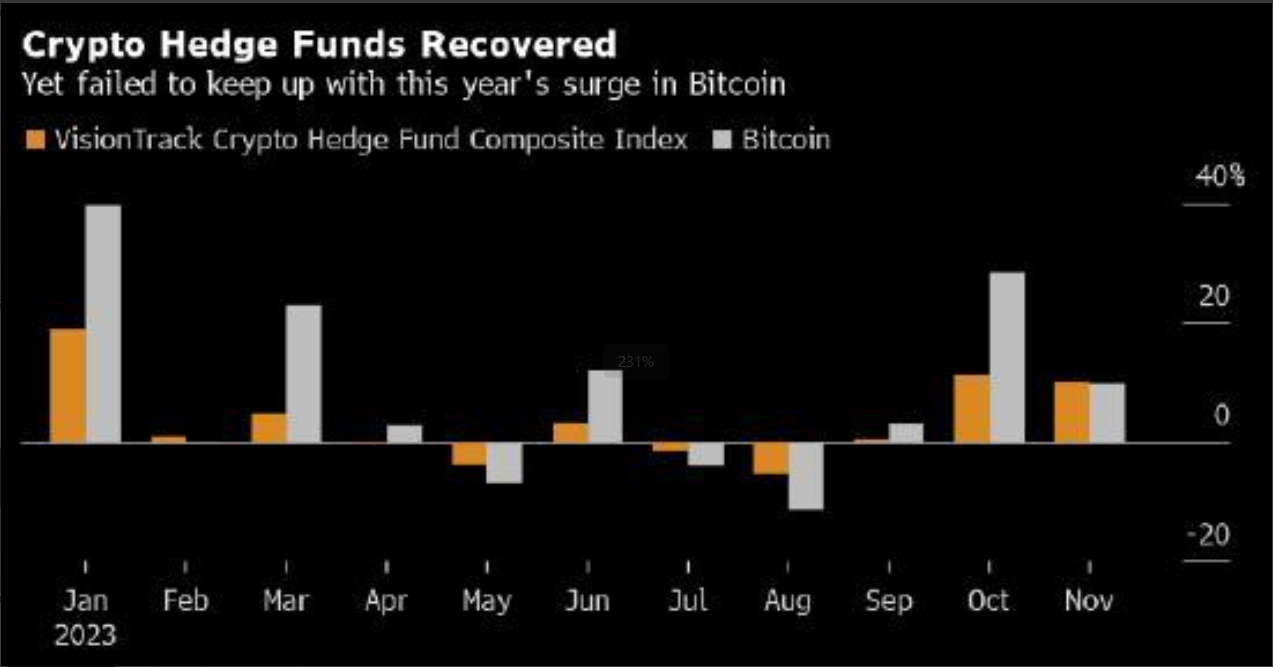

2023 年,我们的主题是“稳中求胜”,并在 Q4 随着行情的迅速回暖,逐渐减仓,最终实现 了全年 75%的增长。当然,整个 2023 年的大行情一路上涨是我们获得回报的主要因素, 我们在全年大部分时间保持满仓,所以基本保持了和行情的同步。在两年的周期内,我们 的总回报率(扣除管理费后)也超过了+30%,是远远好于 BTC、ETH 等主流资产的。 相比之下,曾经业内最知名的基金们,A16Z、Paradigm、Multicoin、Pantera、Sequoia 在市场上已经鲜少露面,那些“积极”的基金们反而在这轮周期中蒙受了巨大的亏损。一项 跟踪加密货币对冲基金表现的指数显示, 截至 2023 年 12 月 20 日,加密货币对冲基金今 年以来平均回报率为 44%,而 2022 年为-52%。这意味着大部分基金甚至都没有完全恢复 自己的本金。而我们 Bizantine 这两个的数据分别是+75%和-24%。

全球加密货币基金2023年逐月市场平均回报率

回看2022年,我们有哪些新的思考?

们依旧坚信,在币圈中保证收益率的最好方式是,切不可因为盲目追求α而丢掉β。而如今币圈中β无非是BTC、ETH两者,因此在2024年,我们依旧会坚持主要资金配置BTC ETH的策略,结合中期的波动进行仓位调整。

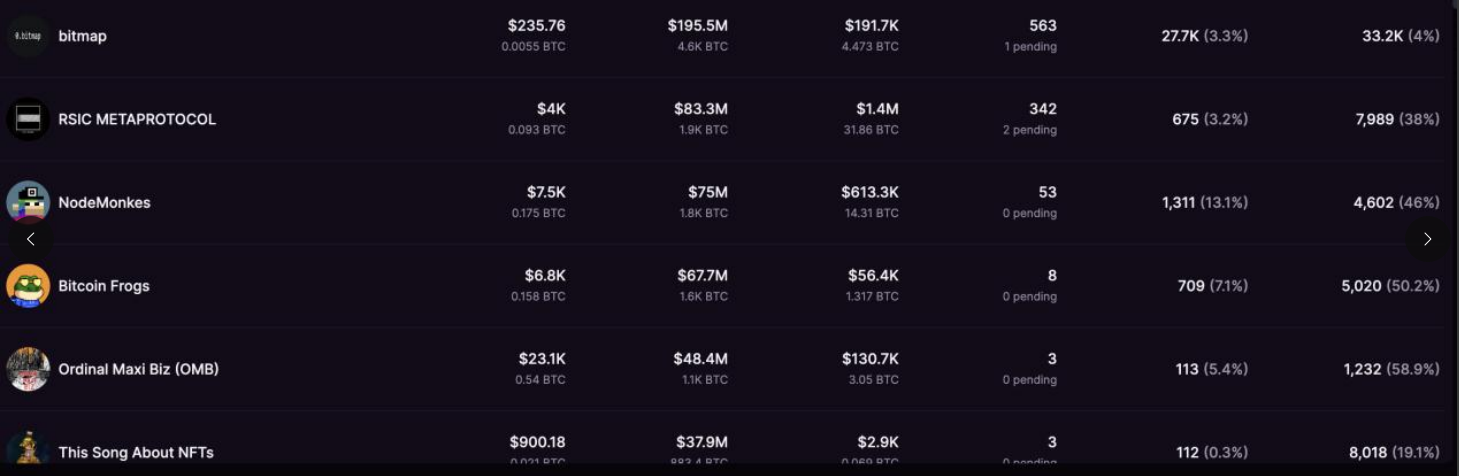

在这个周期中,另一个值得关注的问题是BTC和ETH之争。我们曾经探讨过BTC和ETH 的潜力问题,在2015-2018,2019-2022这两个周期内,ETH最高都曾达到BTC市值的70%,但最终却差了一些火候。但一直以来,我们都坚定的认为,ETH超越BTC是极有可能, 甚至只是时间问题。我曾在2022年的investmentletter中提到自己的观点“当以太坊市值 超过比特币后,我们可能会以另一种不同的策略审视市场。也就是我曾经预测的——当以太坊市值超过比特币后,整个行业最大的基本面不再是比特币的兴衰,而是变为更多依靠行业应用价值捕获而对应的以太坊价格波动,由此行业周期或许不再以四年的“天时”而驱 动,而更多是根据区块链和web3对各细分行业的产业变革之“地利”而驱动,那么届时, 可以想见行业很难再出现一年比特币涨10倍的大牛市,而是更多需要通过α来获得超额 收益”。而在2023年,比特币生态上出现的铭文概念爆火,却让BTC从创世而来的15年 内第一次有了α。发源于比特币的铭文给行业内外提供了一个与以太坊为首的其他公链“智能合约”思路不同的解决方案,简单解释一下:因为以太坊等其他公链从创始之初就可以 支持部署智能合约,因此可以将发币、类似于现实世界的抵押借贷、碎片化等defi行为 全部以智能合约的方式约束,从而将这些行为全部在链上以相对去中心化的方式完成。而比特币是用UTXO的方式进行链上数据传输和交易行为定义,因此无法在链上完成这些资产行为定义,而铭文则采用了将链上交易信息索引到链下的方式,以“半中心化”的方式发 行新资产,将资产信息和metadata等储存在链下,在交易时再回到链上。这种全新的哲学可以看成是“区块链原教旨主义”的倒退,却是拥抱传统市场,降低企业端进入web3门槛的一大进步。

截止2023年底,比特币生态上的前十大项目总市值突破50亿美金。让我对本轮BTC的表现更有期待的是,我和一些认识多年的比特币挖矿大户和矿场主交流,有不少人都罕见的追问我铭文生态的机会,对他们而言,一直将比特币矿机作为一种有稳定产出的实体投资,甚至很多人都不知道怎么使用加密货币钱包。但是比特币生态上有史以来第一次出现“指数级财富效应”,我在他们眼里看到了那种“以前觉得比特币就是挖卖提,现在第一次听说还有机会买到千倍万倍的币”的兴奋感。我相信这是促使很多沉睡多年的比特币挖矿相关资金重新开始进入市场的催化剂,而这些沉睡的巨鲸一旦兴奋起来,完全有实力创造新的赛道和更大的财富效应。

BTC生态子赛道——BRC20协议项目市值排列

BTC生态子赛道——BTCNFT项目市值排列

BTC生态子赛道——ATOM协议项目市值排列

所以,这个周期内,ETH能超越BTC吗?或者说,ETH如果始终无法超越BTC,这个行业是否还能进入“应用价值捕获”的阶段?这两个问题,或许现在的我,相比于两年前,有不一样的答案,或者说,倾向性。

2023年Q4发生了什么?

直到2023年11月底,整个行业可以说依旧一片死气沉沉。比特币价格依旧在30000上 下徘徊。以我在行业内的体感,可以说是熊市漫漫,看不到有太多起色。但就在11月底,随着比特币铭文生态的龙头$Ordi、$Atom等开始暴涨,比特币价格也随着ETF的预期不 断上扬,只用了两周不到,整个行业就出现了牛熊转换。 在这方面,我们的操作稍显保守了一些。我们当时对行情的预计是BTC短期顶部在 43000,ETH短期顶部在2400左右,因此在整个12月逐步减仓,最后全部卖出。而实际上最后在1月10日BTCETF通过后,其价格最高冲到48000,2700。这也是我们在Q4并 未跑赢大盘的主要原因。

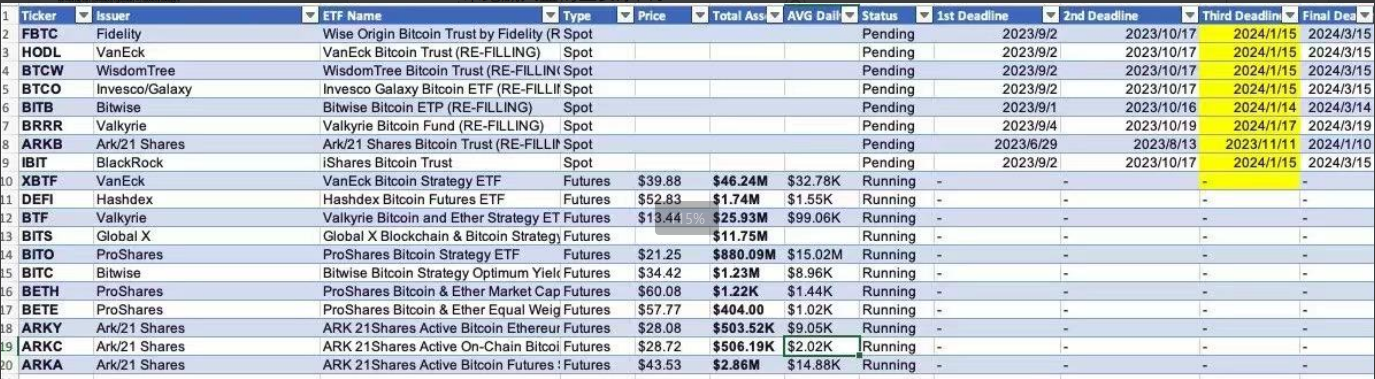

2024年正在申请期的BTC和ETHETF一览

毫无疑问,现在美国和亚洲市场的加密货币格局发生了天翻地覆的变化。美国市场日趋合 规,对于机构资金入场是绝大利好,但是对于热衷于参与各种山寨币的散户确实不够友好。而亚洲市场,香港政府一直大力支持web3发展,结合已经有“加密中心”风范的新加坡, 更多民间资金更愿意在亚洲入局。

2023Q4,尤其是12月的发展超出了我们预期。 按照我的“四年周期”理论,2023年底 2024年初应该只是崭露头角,这轮周期真正的牛市应在2025年到达顶峰,目前来看, 行情走势应该只能算是“复苏”,不过“复苏”便已如此强劲,结合2025年美国降息预期和 全球科技业的回暖,我们对未来完全应该充满期待。

2024年我们需要关注什么?

2024年是“离火九运”二十年的第一年,也必然引领接下去数十年的科技发展。chatgpt和visionpro分别引领了AI和AR行业的变革。在我看来,区块链是和这些概念并驾齐驱的技术,并且为它们提供了新的商业模式和资产形式。曾有笑言,“AI应用们天天费尽心思找护城河,以为自己是城堡,结果到头来一阵风吹过,才发现是沙堆起来的。”AI可以获得大量用户,但是商业模式很薄,我在硅谷和不少AI和AR领域的founder交流,大家都对用户付费购买内容的能力存疑。但是加上NFT的概念,作为“半投资品和半消费品”的属性,会更容易引起用户的fomo情绪和参与积极性。实际上,区块链作为一个“去中心化”的公有产物,最合适的场景就是给同为“publicgoods”的AI应用们创造商业模式和退出路径。而AI+web3也是币安在更新换代后最看重的赛道,最近几期Binancelabs的项目大多都有AI概念。相信在新一轮牛市中币安会作为重要推手将这两个全球科技界最火热的概念进一步结合。

但是,我不想妄言在本轮周期中,区块链就能真的“脱虚向实”——NFT变成一种更广泛存在于元宇宙的数字商品,而不是再是金融产品;数据产业通过区块链完成更加安全的存储和交易,而不只是用来产出代币——以Visionpro为例,未来visionpro内VR/AR的数字内容必然要和元宇宙和NFT进一步结合,而在数字世界中,数字内容和资产的二合一是必然趋势,这样才可以为创作者UGC提供更多的激励。但考虑到visionpro的出货量和现在硬件业的供应链问题,现在还不是谈论数字内容web3化的时刻。这一切,我认为会在下个周期(2027-2030)开始逐渐走入正轨,并不是这个周期我们主要讨论的命题。我们先要解决传统世界法币资金和数字货币的联通、互联网世界用户使用区块链应用尤其是数字货币钱包的门槛这两个问题。

2024的主旋律,一定是“增量资金入场”。而我认为这个资金入场会是“一明一暗”。“明”在于美国BTCETF通过后,ETHETF等势必也会逐渐跟进,而全世界其他跟随美国金融体系的主权国家如英国、韩国等放开ETF也只是时间问题,这会为crypto市场提供完全另一个量级的资金。因此我们在2024年的主要目标是寻找如何引入传统资金的方式,并将我们Bizantine作为机构配资的渠道。我们在新年前夕开设了多家银行账户,并为此设计方案。

“暗”在于,随着Twitter、Telegram、Instgram等社交平台开放web3api,一些知名企业如starbucks、Disney也在发行了自己的NFT,这个周期web2传统用户进入web3的门槛会进一步降低,从而极大普及人们持有数字资产的比率。全世界现在cryptowallet独立地址约有5亿多个,去重后,持有crypto的人数我认为应在1-2亿,其中90后和00后这两代人比例尤其高。而这相比全球股市20-30亿的参与者依然有十几倍的差距。遑论NFT 的持有者不到1000万。目前为止,大部分的web2机构们对待NFT的态度只是“试水”,做了一波市场营销以后就弃之不顾了。我们需要更多企业像当年互联网革命一样——将线上的用户获取途径作为取代线下地推的主要方式——在区块链时代,将web3资产作为企业运营的核心,而不是对web3浅尝辄止就重回web2中心化的老路。

说到币安,这轮主要玩家更迭,最大的变量可能就是币安。每个周期,行业都会有交易所完成重大更迭,比如Coinbase在2021年4月,牛市前夕上市;比如FTX在2022年10 月暴雷破产,将行业彻底拉入熊市。2023年底币安被美国法院宣布罚款,赵长鹏宣布辞职退居幕后,这确实给币安带来了不可知的因素。与此同时,OKX迎头赶上,大肆扩张,其新业务线okxwallet抓住了最近几乎所有的行业新概念,使其迅速崛起;和已经日薄西山的火币形成鲜明对比。考虑到美国监管更加严苛,对散户玩家不够友好,现在入场新资金主要来自亚洲。或许新的牛市周期中,行业老大的交椅真的会发生更迭。

说到这里,不禁感叹一声,3年前Okx因为创始人徐明星进了局子,一度出现短暂的关闭充提币,坊间一度以为Okx将要倒台,而当时币安红极一时,火币依旧是行业最顶尖的几家交易所之一。这不过3年时间,风水轮流转,更告诫我们,“币圈一天,人间一年”,只要不放弃,一切都有翻盘的机会。

2024年刚开始,各种概念便已层出不穷,铭文、Layer3、Depin(DecentralizedPhysical Infrastructure)、ERC404等等,让我稍感忧虑的是,现在币圈的用户群体,对一个项目的 忠诚度已经越来越低,对于事物的判断也已经越来越粗线条。在2017年,刚入行的我们,还会认真阅读项目白皮书,给项目方挑刺;会去项目方社区真诚的和项目方沟通,提出建议。现在我们更多的是看到用户像蝗虫一样迁移,在一些别有用心的kol带领下,追逐热点而没有任何自己的判断。这让很多本应有更长期发展的细分赛道直接在萌芽阶段就因暴涨暴跌而失去了上升势头。

在这样的情况下,我们今年给团队提出的一个目标是,把“交易”和“布局”两种思维方式分立。牛市将至,我们势必会增加操作频率。“交易”需要经常在Twitter上感受市场热点,并且迅速做出决策;而“布局”则需要冷静分析,知道哪些赛道在被世人关注前有,而爆火后有足够大的容量可以容纳资本进入,“大热必死”,对一些还没有受到关注的赛道提前布局。这两种思维方式切不可混淆,否则就会顾此失彼 ——对于交易,我们会根据热门赛道的变更选择对于其上核心资产的交易策略,如BTC生态铭文爆火,我们便在12月加大了BTC的资产配置比重;ERC404崭露头角,我们便会更多关注元宇宙项目龙头资产的价格变化。对于布局,我们依旧看好desci和depin这种在小圈子内开始传播,但尚未引起广泛关注的大资金赛道,并且对其龙头项目进行布局。并且利用我们横跨美国、亚洲,并具备全球化搜索项目能力的特殊优势,对我们看好的项目提供更多的行业内市场支持。

写在最后

毫无疑问,本轮周期最寒冷的阶段已经过去,接下去我们要做的,就是系好安全带,以更加饱满的状态静待牛市的发展。

2023年,我们基本完成了年初的业绩目标,也迎来了加密市场的复苏。

2024年,我们有着更大的雄心壮志,也希望和大家一起共同前行,让梦想照进现实。

The best is yet to come.

On Crypto

The bank collapses of March and the subsequent rallies of Bitcoin and Ethereum reminded that the digital asset class remains a viable hedge to the traditional financial system. The Federal Reserve responded to the collapse by implementing Bank Term Funding Program (BTFP), which returned to all-time-high usage in December. The BTFP covered and insured all US banking deposits, allowing the weakened banking entities to obtain substantial cash holdings without selling their underwater American debt products. The BTFP acted as crypto’s first liquidity enabler, which has arguably been the most instrumental factor in risk assets’ outperformance in 2023.

Following the rise of Bitcoin and Ethereum, animal spirits returned to crypto markets in the summer of 2023. We witnessed a mini on-chain summer, driven by new speculative energy in Ethereum-based meme tokens, such as $PEPE. High gas fees continued to persist on Ethereum, but this did not deter Ether from ranging around its major $1,800 - $2,000+ price support levels, as well as turning Ether into an even more deflationary asset from its previous post-merge lows. Bitcoin continued to hover around the $30k USD levels, while we began to see the first signs of interest in Bitcoin Ordinals—an on-chain Bitcoin trading ecosystem—as well as the outperformances of certain, highly volatile altcoins.

After a relatively lackluster third quarter of crypto price action, the fourth quarter rendered a significant influx of market demand through the pending approval of the first Bitcoin ETF. It had been speculated for months that the SEC would finally approve a Bitcoin ETF, and those rumors were firmly solidified in early January through the approvals of 10+ different ETFs from major entity players. It is important to note that a Bitcoin ETF had been talked about for years, but it was the drive led by traditional finance giants, such as Blackrock, which enabled such a fast turnaround.

In the first few days of Bitcoin’s ETF launch on January 12th, Bitcoin bypassed silver to become the second largest ETF commodity asset class in the United States. The ETF narrative should continue to playout through 2024, as it has become clear the level of institutional demand that exists for crypto-based ETF products, with Ether best positioned as the next approval. 2024 will also harbor a Bitcoin Halvening, an event only once every four years and often leading to significant speculation throughout the entire asset class.

What we have seen from Solana in 2023 has been staggering, with very similar echoes to the massive drives in Ethereum’s on-chain metric appreciation in 2021. Solana was undoubtedly the leader of the crypto market’s fourth quarter price rally, with its price increasing 423% quarter over quarter, with over 1000% growth year over year. Reflecting the massive price increases, the chain saw a surge in network activity, with non-vote transactions and fee-payers growing by 65% and 102%, respectively.

Despite Ethereum’s relatively muted price action, the leading blockchain’s underlying fundamentals have only grown stronger. Ethereum’s rollup networks—its on-chain scaling solution—now transact three times the volume of the Ethereum mainnet, increasing by over 9 100% in the fourth quarter alone. Most notably for the start of 2024, Ethereum's upcoming Cancun-Deneb (Dencun) upgrade is finally around the corner. Dencun renders Ethereum’s rollup transactions 10x more cost-effective, bringing Ethereum’s layer-two fees to an order of magnitude lower than Solana’s and other competing layer-one chains’. Dencun highlights the promise for Ethereum’s scaling vision, that of a singular blockchain offering faster, cheaper, and more secure transactions than any competing chain. The upgrade is currently under testing and is expected to be released in March. In turn, Ethereum’s ecosystem shows the strongest growth for the first quarter 2024, with both Dencun and much anticipated launches by Eigenlayer, Blast, and several other competing ETH restaking mechanisms, which allow ETH stakers to earn additional yields by both securing Ethereum’s mainnet and its layer-two scaling solutions. From an investor’s standpoint, these fundamentals align very strongly with long term value accumulation, as long-term ETH holders surpassed BTC holders for the first time in 2023.

On 2024

We are currently in the early stages of a new crypto market bull cycle, where price and liquidity reflexivity play a significant role in the performance of crypto assets. Our positions are reflected to best maximize the correspondence between macroeconomic liquidity and true crypto fundamentals. We will be looking, however, more aggressively in 2024 to capitalize on the market’s reflexivity, where prominent asymmetric bets remain to be made. We are very excited at specific verticals of the crypto space in decentralized science (DeSci), decentralized physical infrastructure (DePin), and ETH restaking through layer-two scaling solutions.

As we have experienced in present and past crypto cycles, the market is seldom rational at either the start or the end of a cycle. At the start of the cycle, the market’s newest entrants are directionally right, but have seldom done the research to make educated investments. As a result, investments with the strongest mimetic potential—those most easily able to be understood— perform the best. Thus, we underperformed a select group of crypto-assets in 2023, namely Bitcoin, Solana, and several other meme coins. Interestingly, both Bitcoin and Solana provide zero economic utility to the global economy, with the former upended by Ether’s superior digital gold product and the latter by Ethereum’s superior layer-two scaling options.

We are quite excited for 2024, as the start of the year has already signaled that the market is becoming slightly smarter and aligned with our theses. As the market begins to recognize that Ether is the only relevant sovereign cryptocurrency, we are well-prepared for the world an efficient crypto market will create. Our networks across the entire field have enabled us to see most of 2023’s best-performing tokens on-paper, including those with long-term potential for true fundamental value. While DeSci, DePin, and ETH restaking are still mimetic spaces, with no project accruing revenues yet, all three appear to be some of crypto’s few defensible sectors thus far. 2024 will likely see real revenues and thus real liquidity enter the sectors. We are well- prepared for real-world assets to enter a highly scalable, singular blockchain, what we believe will be the strongest narrative of 2024.

Download PDF